In the ever-shifting landscape of cryptocurrency, Bitcoin mining profitability stands as a beacon, constantly fluctuating with market forces, technological advancements, and regulatory ripples. Maximizing returns in this competitive arena requires a multi-faceted approach, a strategic symphony orchestrated with precision and foresight. We delve into the critical components that determine success, offering a detailed analysis to empower miners, both seasoned veterans and eager newcomers.

At the heart of the matter lies the mining rig itself. The hash rate, a measure of computational power, dictates the speed at which a miner can solve complex cryptographic puzzles, earning Bitcoin rewards. Newer generation ASICs (Application-Specific Integrated Circuits) boast significantly higher hash rates compared to their predecessors, translating directly into increased earning potential. However, this advantage comes at a cost – the initial investment in cutting-edge hardware can be substantial, requiring careful consideration of capital expenditure and return on investment timelines.

The price of electricity forms another critical pillar of profitability. Mining is an energy-intensive process, and regions with low electricity costs offer a significant competitive advantage. This geographical disparity has fueled the rise of mining farms in areas with abundant and cheap power sources, often leveraging renewable energy solutions to further reduce operating expenses and mitigate environmental impact. Furthermore, efficient cooling systems are crucial to maintain optimal performance of the mining rigs and prevent costly downtime due to overheating.

Beyond hardware and electricity, the Bitcoin network difficulty plays a pivotal role. Difficulty adjusts dynamically to maintain a consistent block creation rate. As more miners join the network, the difficulty increases, making it harder to solve the cryptographic puzzles and decreasing the individual miner’s chance of earning rewards. Conversely, when miners leave the network, the difficulty decreases, benefiting those who remain. Monitoring network difficulty and adjusting mining strategies accordingly is essential for sustained profitability.

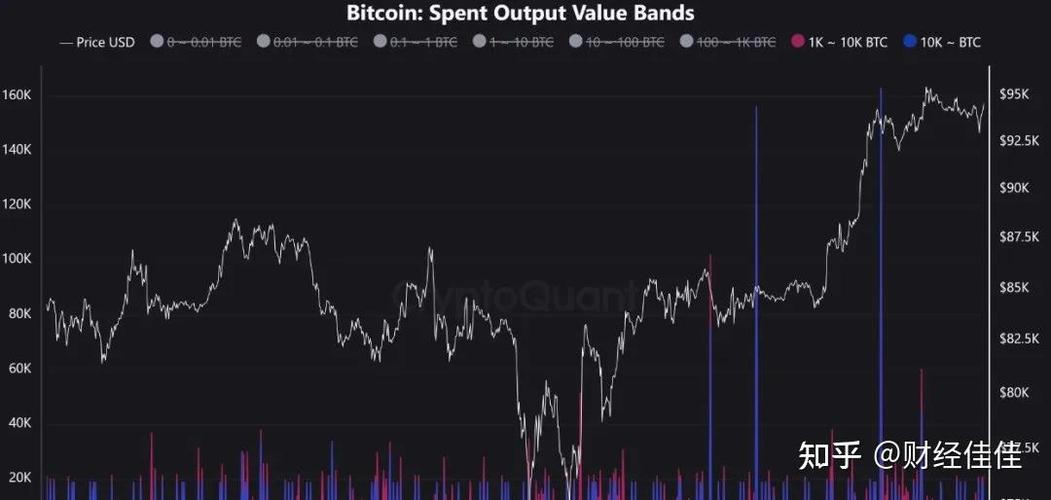

The volatile nature of Bitcoin’s price adds another layer of complexity. A sudden surge in price can dramatically increase the value of mined coins, while a sharp decline can erode profit margins. Miners must therefore adopt risk management strategies, such as hedging or diversifying their cryptocurrency holdings, to mitigate the impact of price fluctuations. Furthermore, transaction fees, earned alongside block rewards, can contribute significantly to overall profitability, particularly during periods of high network congestion.

Mining pools offer a way to smooth out the inherent volatility of mining rewards. By pooling resources with other miners, participants receive more frequent, albeit smaller, payouts. This reduces the risk of going long periods without earning any Bitcoin, providing a more stable income stream. However, mining pools charge fees for their services, which miners must factor into their profitability calculations.

The regulatory landscape surrounding Bitcoin mining is constantly evolving, posing both challenges and opportunities. Governments around the world are grappling with how to regulate cryptocurrency mining, and changes in regulations can have a significant impact on profitability. Miners must stay informed about the latest developments in their jurisdiction and adapt their operations accordingly.

Finally, efficient management practices are paramount for maximizing Bitcoin mining profitability. This includes optimizing hardware performance, minimizing downtime, managing electricity consumption, and staying abreast of market trends and regulatory changes. A data-driven approach, leveraging analytics to track key performance indicators (KPIs), can provide valuable insights and enable miners to make informed decisions.

In conclusion, maximizing Bitcoin mining profitability requires a holistic approach, encompassing careful selection of hardware, access to low-cost electricity, strategic participation in mining pools, diligent monitoring of network difficulty and Bitcoin price, proactive risk management, and adherence to evolving regulations. By mastering these critical elements, miners can navigate the complexities of the cryptocurrency landscape and unlock the potential for long-term success.

This analysis dives deep into Bitcoin mining profitability, exploring various strategies, market trends, and technological advancements. It offers insights on optimizing equipment, electricity costs, and the impact of fluctuating prices. A must-read for miners seeking to enhance their returns in an ever-evolving landscape.